Introduction

Hong Kong, a global financial hub with its iconic skyline, bustling harbors, and rich history, boasts an intricate financial system. Amidst its complex banking and investment sectors, the credit scoring system serves as a crucial determinant for financial opportunities. For those residing in, or planning to transition to Hong Kong, understanding this system is paramount. This article delves into the world of credit scores in Hong Kong, offering insights from its historical evolution to its modern intricacies.

Historical Framework and Context

Hong Kong's financial roots can be traced back to its days as a British colony, where British banking traditions laid the foundation for the territory's future financial landscape.

Early Days

Post-World War II, Hong Kong began its rapid transformation into a global financial center. The influx of migrants, businesses, and investments necessitated a robust credit system.

Transition to Modern Banking

As the territory transitioned towards a more autonomous financial entity in the late 20th century, local regulations and systems, like the credit scoring model, began to take shape, influenced by both British traditions and emerging global standards.

Post-Handover Evolution

After 1997, when Hong Kong became a Special Administrative Region of China, the financial system, while retaining its uniqueness, saw influences from mainland Chinese policies and practices.

How Credit Score Works in Hong Kong

In Hong Kong, the Credit Reference Agency (CRA), notably TransUnion, is responsible for credit reporting.

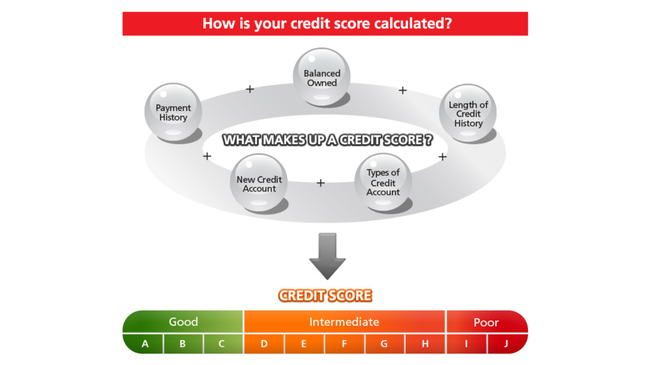

Scoring Metrics

Hong Kong's credit scores usually range between 300 and 850. Factors considered include payment history, credit utilization, length of credit history, and recent credit applications.

Accessing Reports

Individuals have the right to obtain a free credit report annually to understand their credit standing. This aids in both personal financial planning and ensures transparency in credit evaluations.

How to Access Credit?

Prerequisites

Identity Verification

Residents use their Hong Kong Identity Card, while foreigners typically need a valid passport.

Proof of Income

Usually in the form of recent pay slips or tax documents.

Residency Proof

A recent utility bill or bank statement is typically adequate.

Terms and Conditions

Interest Rates

Varying across loan types and banks.

Repayment

Depending on the credit type, repayment periods can range from short-term to several years.

Securities and Guarantees

Larger loan amounts may necessitate collateral or guarantors.

Curiosities and Tendencies

Digital Innovations

With the rise of fintech, digital platforms now offer faster credit assessment and approval processes.

Mainland Influence

As mainland Chinese banks establish their presence in Hong Kong, there's an observable synergy between Hong Kong's credit systems and those of the mainland.

Financial Education

There's an increasing emphasis on educating the public about credit scores, promoting better financial management among residents.

Conclusion

The dynamic financial landscape of Hong Kong offers both challenges and opportunities. As the city continues to evolve, so does its credit system, reflecting both its rich history and its forward-looking aspirations. For individuals, a sound understanding of this system isn't just beneficial—it's essential. In the ever-evolving world of finance, being well-informed is the key to making empowered decisions.