Introduction

In the dynamic and fast-paced economic environment of Singapore, one's ability to navigate the financial seas often boils down to a crucial three-digit figure – the credit score. This number, seemingly abstract to many, is a reflection of one's financial discipline, responsibility, and past actions. Yet, despite its importance, many in Singapore, both locals and expatriates, are often left in the dark about how this score is derived, its historical relevance, and the tangible impacts it can have on daily life. Before diving into the heart of Singapore’s financial sector, understanding the credit score is a pivotal starting point. From its inception to its everyday consequences, let's unravel the mysteries of the credit score in the Lion City.

Historical Framework and Context

In the past, lending was predominantly based on personal relationships and trust. Moneylenders in Singapore, like in many parts of the world, relied on one's reputation in the community to decide if they were worthy of a loan. Fast forward to modern times, the evolution of the banking and finance sector required a more systematic approach, thus paving the way for the introduction of credit scores.

Singapore’s Credit Bureau Singapore (CBS) was launched in 2002. It marked a transformative step in standardizing the lending process by offering a centralized repository of consumer credit information. This information is provided by financial institutions to help lenders make informed lending decisions, reducing default risks.

What is a Credit Score?

Simply put, a credit score is a numerical representation of a person's creditworthiness. It's calculated based on an individual’s credit payment history, outstanding debts, length of credit history, type of credit used, and recent searches for credit. Lenders utilize this score to evaluate the risk posed by lending money to a consumer and to mitigate losses due to bad debt.

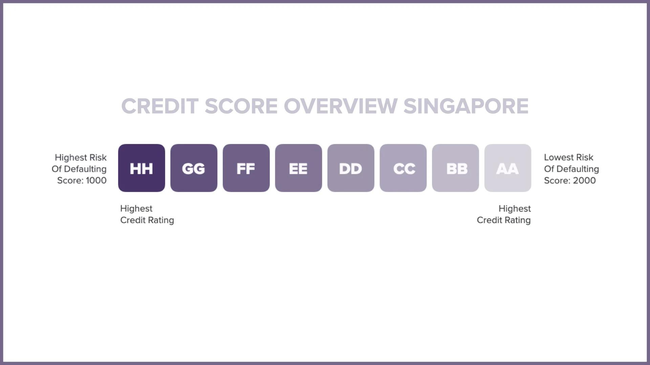

How it Works? Punctuation and Range

In Singapore, CBS calculates the credit score on a scale from 1000 to 2000. Here’s a general breakdown:

AA: 1911-2000 (Low Risk)

BB: 1844-1910 (Low to Medium Risk)

CC: 1825-1843 (Medium Risk)

DD: 1813-1824 (Medium to High Risk)

EE: 1782-1812 (High Risk)

FF: 1755-1781 (Very High Risk)

GG: 1000-1754 (Default)

The closer your score is to 2000, the more creditworthy you appear to lenders.

Consequences of a Bad Credit Score or Defaulting on Debt

Possessing a bad credit score in Singapore can have significant repercussions

Higher Interest Rates

Those with lower scores might still obtain loans but at higher interest rates, leading to more expensive borrowing costs.

Loan Rejection

A very low score can lead to outright rejection of credit applications.

Difficulty in Securing Housing or Jobs

Some landlords and employers check credit scores as a measure of responsibility. A poor score can make renting or landing certain jobs challenging.

Difficulty in Setting Up Utilities

Companies might demand a security deposit if you have a bad credit score.

Legal Implications

Defaulting on loans can lead to lawsuits, garnishment of wages, or even bankruptcy.

Conclusion

The intricacies of the credit score system in Singapore, like its skyline, are multifaceted yet deeply intertwined. In a nation that prides itself on economic prowess and financial discipline, understanding one's credit score is more than just grasping a three-digit figure. It’s about comprehending the underlying principles of trust and responsibility that have steered Singapore's financial journey from its humble beginnings to its status as a global financial hub. As consumers, the onus is on us to stay informed, remain vigilant, and act responsibly. By doing so, we not only safeguard our financial futures but also contribute to the broader tapestry of Singapore's robust economic framework. In the end, the credit score isn’t just a reflection of our past financial behaviors but a beacon, guiding our future financial endeavors in the shimmering city-state of Singapore.